A positive forecast for Wynn Resorts is highlighted by Fitch, which notes the solid recovery in Macau.

When anticipating a healthy financial outlook for Wynn Resorts, Fitch Ratings suggested that the "strong rebound" that Macau experienced after the Covid-19 pandemic was a contributing factor.

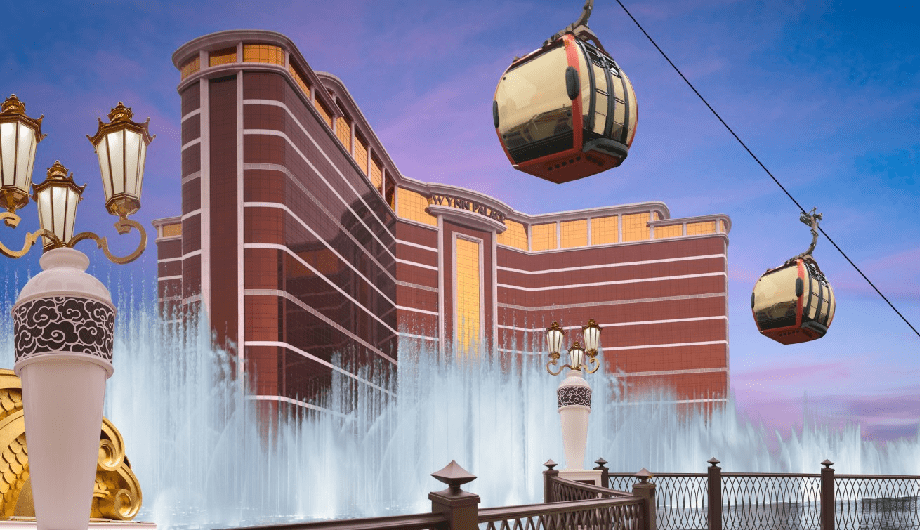

The Wynn Resorts in Macau

Macau's casino industry suffered a significant setback as a result of the pandemic, which resulted in highly stringent restrictions that brought the market to a complete halt.

On the other hand, the industry has shown an amazing response to the elimination of travel restrictions that will take place in the beginning of 2023. It is estimated by Fitch that the mass-market baccarat market has returned to its levels prior to the pandemic, particularly in the premium mass market that Wynn attempts to attract.

During the fourth quarter of 2023, the number of people playing baccarat on the mass market was 91% of the numbers in 2019. Both the number of visitors and the capacity of airlines are still lower than the figures for 2019, which indicates that the industry may experience even more revenue growth in the not too distant future.

In the fourth quarter, Wynn's Macau businesses brought in $910.6 million (£718.5 million/€838.9 million). In what was yet another great quarter, Wynn Palace contributed $524.4 million to that total. The EBITDAR margins for mass-market revenue and property assets for the third quarter of 2023 are already higher than those for 2019.

Due to the fact that Wynn Macau is increasingly focussing on the premium mass market rather than the VIP sector, Fitch observed that the property's recovery was slower than expected.

Wynn's development in terms of finances

Within the next five years, Wynn's EBITDAR leverage is expected to increase from just below 7x in 2023 to low-5x, according to Fitch's forecast. Fitch believes that ongoing growth in Las Vegas and Macau will be beneficial in this regard, since it will lead to an increase in EBITDA and a partial decrease in debt.

Resorts owned by Wynn

An integrated resort is being constructed by Wynn on the artificial island of Al Marjan, which is located in the United Arab Emirates.

Additionally, it is anticipated that the operator will have a positive free cash flow (FCF) over the course of the forecast horizon. With $2.8 billion in cash on hand, $792 million in short-term investments, and $737 million of available funds on the Wynn Resorts Finance LLC (WRF) revolver, Wynn is in a great position with regard to its liquidity.

Wynn's credit position is expected to continue to strengthen, according to Fitch, despite the fact that the company is currently working on substantial projects in places like as Las Vegas and the United Arab Emirates. One such possibility is the establishment of a casino in the state of New York.

Wynn's success in Macau in spite of the United States' rollback

In the previous year, Wynn made the announcement that it would be considerably reducing its activities in the United States. The company had already halted business in the states of Arizona, Colorado, Indiana, Louisiana, New Jersey, Tennessee, Virginia, and West Virginia prior to its departure from Massachusetts over the previous week.

US tax on wagering on sports

Wynn's sports betting licenses in New York have been acquired by Penn, according to an agreement.

In addition, Penn Entertainment reached an agreement last week to acquire the sports betting licenses held by Wynn Interactive Holdings in the state of New York. This will make it possible for Penn to start ESPN Bet in the state in the year 2024.

Despite this, Wynn activities are still currently being carried out in Nevada, with Las Vegas income increasing by 16.3% to reach $2.48 billion in 2023.

Craig Billings, the chief executive officer of Wynn, made the following statement in reference to the company's operations in Las Vegas: "In Las Vegas, we continue to distance ourselves from peers as the leader in luxury." The fact that we are the place to go for the most loyal consumers who are attending citywide events such as Formula One is more obvious than it has ever been.